In the professional economic literature, one can find various definitions of the concept of "inflation". The vast majority of definitions of inflation associate it with an increase in the general price level or depreciation of money. The authors of the popular textbook "Economics" K.R. McConnell and S.L. Brew write: “Inflation is an increase in the general level of prices. When inflation occurs, each dollar can buy fewer goods and services than before. In other words, inflation reduces the purchasing power of money. This does not mean that all prices are rising. Even during periods of rapid inflation, prices may remain relatively stable or decline. One of the most painful manifestations of inflation is that prices rise very unevenly.

What is Inflation?

Inflation is a phenomenon that is inherent in every society. It existed both in the feudal, slave-owning system, and so it exists in the modern world, although its roots go much deeper. The term "inflation" (from the Latin inflatio - swelling) first began to be used in North America during the civil war of 1861-1865. It denoted the process of swelling of paper-money circulation. In the 19th century, the term was also used in England and France. The concept of inflation became widespread in the 20th century after the First World War. If earlier inflation arose, as a rule, in emergency circumstances (war, revolution, change of political regime), then in the last two or three decades it has become chronic in many countries. The phenomenon of inflation is inherent to one degree or another in any market and transitional economies, including the economies of industrialized countries.

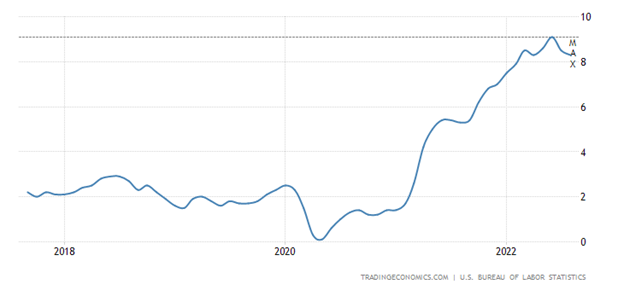

Currently, significant inflationary processes are also observed in the US economy. The inflation rate in 2022, presented in the chart, reached its maximum value in 5 years and amounted to 8.3% in August 2022. At the same time, inflation accelerated for natural gas, electricity, food (highest since 1979), housing (highest since 1984), and used cars and trucks.

Figure - The inflation rate in the United States in 2018-2022

Inflation and Personal Loans

Each of us wants to protect our savings from inflation. To do this, we need to make such investments that will allow us to receive a return at least not lower than the inflation rate. Traditionally, such investment instruments are stock market instruments (stocks, gold, short treasury bills (FXTB and FXMM), inflation-linked bonds - TIPS (Treasury Inflation-Protected Securities)).

Buying them today is very easy. You just need to choose a personal loan for yourself, invest it in the instrument we like and start receiving passive income from investing.

To receive a loan, you only need to meet a few conditions:

- be able to verify your identity and US residency by providing proof of identity;

- be able to confirm the level of their income and employment by submitting a certificate from the employer;

- be 18 years of age or older.

The advantage of these loans, the funds from which you can invest and protect yourself from inflation, is that even your bad credit history will not be an obstacle. Of course, the lender will perform a soft credit check, but they do it solely to make sure that taking such a loan does not worsen your credit history.

You will get even more benefits if you decide to attract an online loan such as 5000 loan for bad credit for investment. Here are the most important ones:

- the online application process is simple and fast and takes only 5-10 minutes. You only need to have a device connected to the Internet, and you do not have to go to the office of a credit company;

- approval of your online application for a loan occurs almost instantly after it is received by a loan officer;

- financing under the loan agreement is also very fast – often within one day from the moment the online application is submitted.

How to Protect Yourself Against Inflation

So, what do you need to do to protect yourself from growing inflationary processes:

- to understand that inflation in modern conditions is an inevitable economic process;

- decide for yourself that high-yield investments are a proven remedy for it;

- choose for yourself the best tool for such investment;

- determine for yourself the necessary amount that you intend to invest;

- find a loan company that will easily provide you with a personal loan for such an investment, even if your credit history is not quite perfect;

- to save time, choose the option of online lending;

- fill out an online application, wait for the approval of the loan, receive funds to the specified bank account (or in another convenient way) invest the funds received in the selected investment instrument;

- no longer think about rising prices caused by rising inflation.